The Crookston Public School District held a public meeting on Tuesday night in the Crookston High School Auditorium about the multi-use facility.

Interim Superintendent Dave Kuehn presented why the district wanted the facility. He explained that the University of Minnesota Crookston owned their current facilities for track and football, and due to them not owning the facility, this prevented them from using their Long-Term Facilities Maintenance (LTFM) dollars designated to pay for upgrades since it was not their property. Kuehn noted they could perform maintenance and upgrades to the field, but it would have to come out of their General Funds, which are primarily used to fund academic needs and day-to-day operating expenses. He also noted that UMCs current track surface was not safe enough for them to host competitive track and field meets.

Kuehn then went into the benefits the project could give the district and community, saying the facility could provide broader opportunities and benefits for students and community members as many groups, including athletic teams, park and recs programs, and outside groups could use it. It also would be close to the school to make it easy for groups like the marching band, physical education, and sports teams to use the facility for their practices and games, and would be much closer to the school parking lot. The new referendum would also allow the district to host Minnesota State High School League playoffs, and section track and field meets, which can be helpful to many local businesses.

Kuehn then went into the preliminary tax estimate, in which he explained that because the project price increased by just over a million dollars due to escalated construction costs, the tax impact on community residents had increased noticeably compared to its impact during the summer. “Comparing this tax impact for this $4.9 million project versus what we were talking about in August. If you had a $200,000 resident home, your tax impact would have been $29 a year. By going up to $4.9 million, the tax increase now for a $200,000 home is $33, so it went up $4,” Interim Superintendent Dave Kuehn explained. “Any tax impact is an impact, but the amount that went up for residential and businesses was, yes, an increase, and I think the last time we talked about the Ag Tax Credit and what it would cost farm acreage and the homestead property, they had negative numbers and was hard to explain, but the numbers now I think makes more sense.”

Kuehn noted that while there would be more of a tax impact on the community, he hoped the community would see the facility’s impact on the community would be worth the increase. Kuehn then gave an example of the tax’s impact with Shelby McQuay of Ehlers Public Finance Advisors, with the estimated average market value per acre at $4,000, this would cost the owners $153 per year for that property, which was a significant decrease before Ag Credit was introduced which would have been a payment of $444. However, some audience members noted that their example was lower than the actual impact on their taxes and requested the district to use examples of more realistic numbers to show the facility’s impact on their taxes. “We had an example because people didn’t understand the Ag tax credit, and what that meant was if I had an “x” amount of acres and the price of an acre of land in different townships, and we know that varies. The example we picked was below the average, but we had some Ag people who figured a $6,000, $8,000, or $ 10,000 per acre price was better than 4,000. They felt that wasn’t realistic,” said Kuehn. “So we’ll update your information and get more of those prices into your example, and that’s great information and advice. We will do that for our many next presentations to ensure we get that input into our presentations.”

Kuehn mentioned there were also Special Property Tax Refunds available each year to owners of homestead properties with a gross tax increase of at least 12% and $199 a year prior, which can be helpful in the first year of the referendum. It would have a refund of 60% of the amount by which tax increases exceed greater than 12% or $100 up to a max of $1,000.

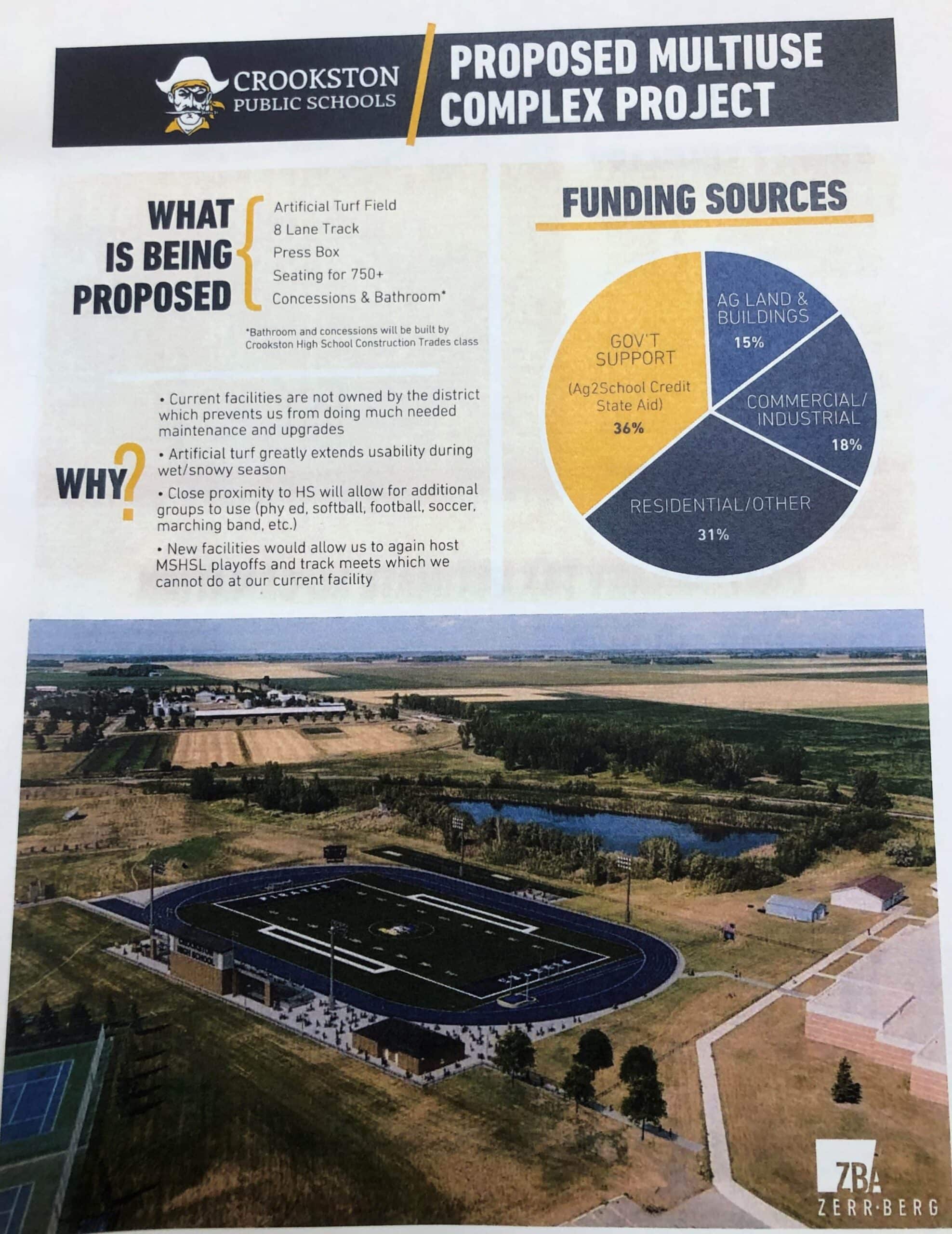

Kuehn then went into a summary of the budget, explaining that the estimated costs for the project are $4,964,671 with a Bond Issue Total of $4,965,000, with the Artificial Turf Field’s construction costing $1,182,000, the track’s construction costing $837,000. The Grandstand & Press Box’s installation cost $387,000, the Lighting/Electrical work cost $715,000, and the Site work cost $924,000. The construction cost for the Concessions Stands and Bathrooms would be $178,000, with other contingency costs equaling about $741,571. He explained that they were getting a lot of funding from the State due to the Ag2School Credit State Aid, which is paying about 36% of the project, making it, so Ag Land and Farmers only have to pay 15%. Commercial and Industrial businesses would cover about 18% of the project’s cost. Leaving the final 31% being covered by resident taxes and other sources.

Kuehn then opened the presentation to the public for any questions they had. Crookston High School teacher Tim Moe brought forward a question that was asked to him about how the seating limit of the facility compared to UMC’s field. Kuehn explained that UMC could hold about 1,000 people, which was more than what the facility could hold but noted that they could add new bleachers around some areas to increase the number of bleachers they could have for people to sit.

Another question was why only one design was available for the community to vote on. John Holten of Zerr Berg Architects explained that with the scope of the project, other additions and changes could be added, but they would push over their budgeted amounts of $4.9 million, which the district would have to pick up, which the district would have to find other ways to cover the costs.

One audience member asked for a breakdown of the press box and grandstand to know what would cost what for its construction. Kuehn and Holten explained that the press box cost $90,000. When asked why the facility needed a press box, Holten explained that sports teams coaches use it to call plays and have an elevated view of the field.

When asked if they would use fundraisers or sponsorships to help cover some of the expenses the referendum needed. Kuehn answered that the district was planning to meet with several local organizations to get sponsorships for the referendum if it is passed on February 14. “We’ve laid the groundwork with maybe a few businesses that maybe would be interested in helping with some fundraising or field-naming, but I don’t want to put the horse before the cart,” Dave Kuehn explained. “We need to get the project approved, and I think we have momentum in the community with some of our businesses, and I know there are people interested in putting their name on the field, scoreboard, or pressbox, so we feel those sponsors and businesses are in our community and are waiting for us to come with the plan, and until we really know the cost of the project and the what the referendum will cover and how much we need to raise, then we can go out and finalize things with local businesses with marketing and sponsorship revenue from that.”

One member asked when the last time the track at UMC was replaced, to which Kuehn replied may have been about eight to 10 years and noted that it shouldn’t even be used for practices. The person followed up with how asking about the lifespan of a turf field and new track and how much it would cost to replace, to which Holten answered would cost about $300,000 to replace the carpet of the turf, which their LTFM dollars would cover.

The next public meeting about the facility will be on Tuesday, January 19, in the Crookston High School Auditorium. Pictures of the presentation and forms about the preliminary tax estimate can be found below-

[embeddoc url=”https://kroxam.com/wp-content/uploads/2022/12/Multiuse-Sports-Complex.pdf”]