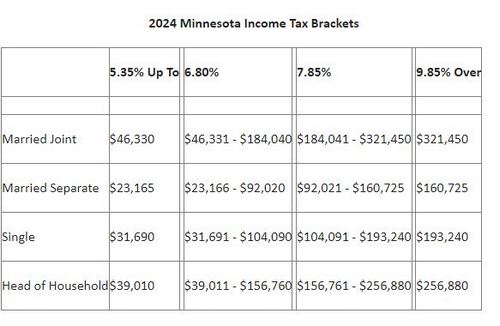

The Minnesota Department of Revenue announced the adjusted 2024 individual income tax brackets. For tax year 2024, the state’s income tax brackets will change by 5.376 percent from tax year 2023. This annual adjustment will prevent taxpayers from paying taxes at a higher rate solely because of inflationary changes in their income.

Indexing for individual income tax brackets inflation is required by law and first began in 1979. The shelves are adjusted annually by an inflation factor, rounded to the nearest $10, based on the change in the U.S. Chained Consumer Price Index for all urban consumers. After adjusting for inflation, the married separate brackets are half the spousal joint amount. The adjustment does not change the Minnesota tax rate for each income bracket.

The brackets apply to the tax year 2024. Taxpayers who make quarterly payments of estimated tax should use the following rate schedule to determine their costs, which are due starting in April 2024.

You can view a complete list of inflation-adjusted amounts for tax year 2024 on the website or by searching our website using the keyword inflation adjustments.

2024 STANDARD DEDUCTION AND DEPENDENT EXEMPTION AMOUNTS

For those taking the standard deduction or the dependent exemption at the state level, Minnesota has calculated those amounts for 2024. The normal deduction amounts below assume a legislative solution in 2024 to a drafting error in the 2023 tax bill that used the incorrect year for the inflation adjustment of the standard deduction. The 2024 amounts are:

- Married Filing Joint standard deduction – $29,150

- Married Filing Separate standard deduction – $14,575

- Single standard deduction – $14,575

- Head of Household standard deduction – $21,900

- Dependent exemption – $5,050

Find more information on standard deductions, including standard deductions for those who are blind or are 65 and over, on the department’s website.

Tags: