Crookston Public Schools will be asking voters to vote on the following ballot questions on November 5. The election will take place at St. Paul’s Lutheran Church located at 1214 University Avenue, Crookston MN from 7:00 am to 8:00 pm.

Ballot Questions:

Question 1: The board of Independent School District No. 593 (Crookston), Minnesota has proposed to revoke all of the School District’s existing referendum revenue authority, $604.51 per pupil, and replace it with a new referendum revenue authorization of $523.10 per pupil (a decrease of $81.41 per pupil). The proposed referendum revenue authorization would be first levied in 2019 for taxes payable in 2020 and applicable for ten (10) years unless otherwise revoked or reduced as provided by law.

Shall the revocation of the existing referendum authority and the replacement with a new referendum revenue authorization proposed by the board of Independent School District No. 593 (Crookston), Minnesota be approved?

BY VOTING “YES” ON THIS BALLOT QUESTION, YOU ARE VOTING FOR A PROPERTY TAX INCREASE

Question 2: Bus Garage

Shall the board of Independent School District No. 593 (Crookston), Minnesota be authorized to issue general obligation school building bonds in an aggregate amount not to exceed $2,985,000 for acquisition and betterment of school sites and facilities, including but not limited to, construction of a bus garage?

BY VOTING “YES” ON THIS BALLOT QUESTION, YOU ARE VOTING FOR A PROPERTY TAX INCREASE

Q – Why does the School District need to rely on an operating levy?

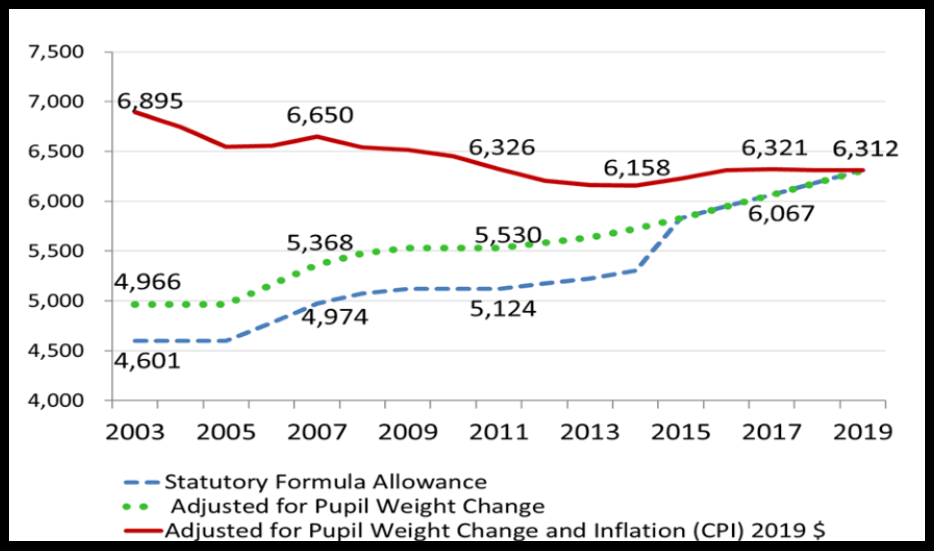

A – State Aid to schools has not kept up to inflation. When adjusted for inflation, schools receive less in state aid than in 2003. This is why 97% of MN schools rely on operating levy’s compared to 60% in 1993. Schools have to do more with less funding (see state aid adjusted for inflation chart from the Minnesota Dept. of Education).

Q – How will voting yes for both questions help Crookston Public Schools?

Q – How will voting yes for both questions help Crookston Public Schools?

A – Question 1 will allow Crookston Public Schools to continue to receive over $1 million dollars in revenue to continue to operate the schools in the district. Question 2-provides for the building of a new bus garage to replace the current bus garage that is over 80 years old.

Q – Will voting yes to these questions increase my taxes?

A – For commercial and residential property, voting yes to question 1 will decrease your taxes. We are asking voters to repeal the $604 per student referendum and replace it with a $523 per student referendum. We are required to have the statement “this will increase taxes” on the ballot even though taxes will be reduced by voting yes. This is simply because we are asking voters to vote on this more than one year early.

Voting yes to question 2 will increase taxes on commercial, residential, and agricultural property. For instance, on a home valued at $125,000 the cost increase would be $7 per year. For additional information and tax impacts please reference the tax impact chart located on the district website under referendum information.

Q – Why does the current bus garage need to be replaced?

A – The current cold storage portion of the bus garage is in very bad shape. The building is leaning and we cannot continue to use this building for much longer due to issues with water infiltration and overall condition of the structure. The current mechanical bay is in decent structural shape, however, is not practical for our taller and larger buses. While it is grandfathered in under the 1935 codes, it does not meet current health and safety codes.

Q – If voting yes for question 1 will reduce taxes for residential and commercial property why does question 1 state that my taxes will go up?

A – This is the way that school districts are required to list ballot language for referendums that are being brought forward for replacement more than one year early. Even though voting yes will decrease taxes for commercial and residential property (no tax effect to ag land), we must include this language on the ballot even if taxes will decrease.

Q – How is this bus garage proposal different than the last proposed bus garage?

A – The last bus garage referendum question was for a 3.4 million dollar building. The current proposed building fulfills all of the same requirements and functionality. The only function that was not included is a fueling station valued at $130,000. We also are not including cost increase for construction inflation over the past two years. We estimate the cost inflation to be about $125,000.

In other words, the current proposal is about 500,000 dollars less expensive in spite of construction inflationary costs over the last two years.

Q – What would be the estimated cost of building a nearly identical bus garage if the purpose would be Ag related rather than having to follow School Construction Codes?

A – We estimate the cost of construction to be about 1.6 million dollars with the following required components removed: Cost of asphalt, air handling system for bringing in fresh air, fire suppression, ADA requirements for bathrooms, contingency costs, and architect fees, etc. All of these components with the exception of contingency, that could be deleted in a non-school application are required in a school application.

In other words, it costs us more to build this building due to legal requirements that schools have to follow.

Tags: