Crookston Public Schools Superintendent Jeremy Olson released the first Referendum Communication for a New Track & Field Athletic Complex earlier today. All the information, including estimates for how it will effect the taxpayers, can be found down below –

Referendum Communication #1: February

As you have no doubt heard, we are embarking on a referendum that asks our voters whether or not we should build a multi-use facility with a new track and turf football field that can be used for softball and soccer as well. The price tag on this project is 3.9 million dollars of which 36% would be paid by the state in the form of a credit on Ag Land through a program called Ag2School. While this work has been going on for quite some time, I wanted to go through this process with you so that you understand the thought process that has led to this referendum.

Why are we doing this and aren’t our current facilities good enough?

Our current track and football field is located at the University of Minnesota Crookston on UMC land. This has been a long-standing partnership. Our local UMC administration has been wonderful to work with and we highly value their continued partnership; however, what once made a lot of sense no longer works. UMC no longer has a football or track team and the current track has been deemed unsafe to compete on, which means that we haven’t been able to host home track meets for quite some time. All home track meets are now held at East Grand Forks on their newer facilities. At this point the grass football field at UMC is useable, however, there will need to be investments made to keep this field playable. The annual repair and maintenance funding allocated to schools is contingent on being used to repair and maintain facilities that the district owns or has a lease to own. These repair and maintenance funds are known as Long Term Facilities Maintenance (LTFM) and are allocated through a state aid/local tax dollar formula that local school districts receive based on the age of their buildings and total enrollment. This funding is significant and would allow for the ongoing repairs and replacement of these facilities if they were located on district land. We confirmed with the state that a simple lease that does not result in the district eventually owning this land will disqualify us from using LTFM. Therefore, it is vital strategically that whatever we do with facilities results in the project qualifying for LTFM as this funding stream will allow for the future maintenance of our facilities without coming back to taxpayers for operational funding.

What steps have we taken?

Several months ago, we started a conversation with UMC regarding how we could continue this partnership in light of these situational changes. Through much discussion, UMC offered a 20-year lease as long as we removed and replaced the existing track. It was a very fair and balanced offer; however, we declined this offer because it would not make fiscal sense as we could not tap into our LTFM funding as the land would still not be owned by the district. We countered and offered to purchase the land, build a track/football field and allow UMC continued use of this space as continuing to collaborate made a lot of sense. This offer was escalated to the larger University system and was eventually refused. I want to be clear that this offer was refused by the larger system and not by our local UMC administration. If we do not own the land then any facility that would be constructed or repaired would need to come from K-12 education funds or come from local taxpayers in the form of a referendum. In addition to this, every time we replaced the track or updated the field these expenses would hit the local taxpayer. The School Board reviewed this information and made the decision that it made more sense and would cost taxpayers less in the long run to initially fund a new facility with a referendum and then for the ongoing maintenance and replacement to use LTFM funding so that we were not coming back to taxpayers for the resurfacing of the track or repair of the facility. We also engaged a committee of community members to study what we needed for facilities. We had several meetings around what we needed in a multi-use facility. Turf vs. grass, six lane vs. eight lane track, shape of the track, and uses of the complex. These conversations were incredibly helpful as we designed the layout of this multiuse facility.

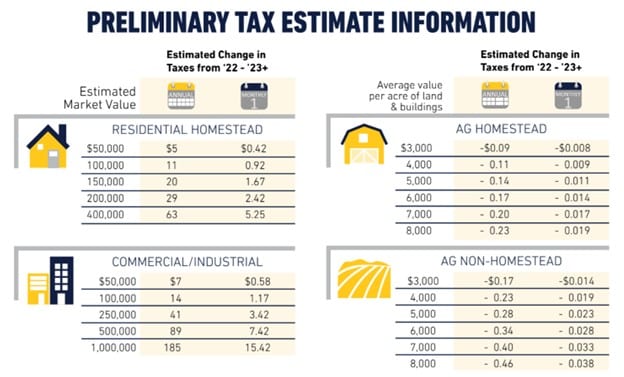

What will the tax impact be?

Ag land will not see increases in a given valuation as the percentage of credit for the Ag to School moves from 60% to 70% which has an offsetting effect of actually lowering the tax impact per acre. Residential and Commercial property will see increases in taxation with this proposed referendum. If you own a home valued at $150,000 dollars your tax increase would be $20 for the year. Please see tax chart for additional valuations for residential, commercial, and Ag. If you own a home valued at $150,000 dollars your tax increase would be $20 for the year.

It is our intention to bring a strong value to our tax payers. We are proposing a good project that is reasonable in cost, and have tried to put together a fiscal package that is affordable for our taxpayers. More information will be following this article; however, my intention was to give you an overview of the project and how we arrived at this point. If you have any questions or comments, please feel free to give me a call 218-770-8717 (cell), email me at jeremyolson@isd593.org, or stop into the district office located off the east parking lot at Crookston High School. My intention and commitment to you is to communicate about this project in an honest and transparent manner. Go Pirates!